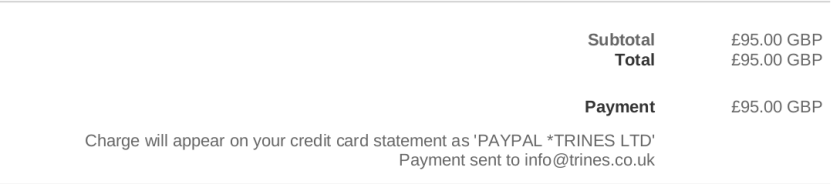

Made a £95.00 payment for an online English teacher training course through Paypal. Immediately after the payment I got an email from Paypal. This email clearly said “Payment sent to ….”. See screen shot below:

However, it turned out the school hadn’t received the payment, and as a result I wasn’t enrolled automatically.

After many telephone calls and emails with the school and somewhat heated exchanges (not the best way to start a relationship), they enrolled me manually.[1]

I complained to Paypal, and their auto-reply email said they will respond within 4 weeks or 8 weeks. I heard nothing back. So I complained to the Financial Ombudsman Service (FOS).

After about a month, an adjudicator got back to me and said the FOS can only adjudicate on the terms of the contract between Paypal and myself. I immediately objected because the FOS is governed by the rules and guidelines of the Financial Conduct Authority (FCA), and these rules [2] say:

“In considering what is fair and reasonable in all the circumstances of the case, the Ombudsman will take into account:

(1) relevant:

(a) law and regulations;

(b) regulators’ rules, guidance and standards;

(c) codes of practice; and

(2) (where appropriate) what he considers to have been good industry practice at the relevant time.”

I then pointed out that the FOS needs to consider laws and regulations passed by Parliament, EU Directives (incorporated in to national laws), and guidance and standards (set by the Financial Services Authority). These were specified in an email to the adjudicator.

This was his response:

“The arguments you’ve presented may be better suited to a court of law as it’s primarily courts who have the power to interpret legislation and EU regulations. So, there’s nothing to stop you from pursuing your complaint through other means.”

I told him that the Court option (although theoretically available) is seldom used by consumers due to time/cost and complexity of the legal system. He still didn’t feel it was “fair or reasonable” to uphold the complaint (decide the complaint against Paypal).

The complaint was passed to an Ombudsman, who took less that 2 pages to “rubber-stamp” the adjudicator’s decision. More worryingly, the Ombudsman has ignored the laws passed by Parliament. You can read the full decision here. [3]

Commentary about decision

The points in the decision I find very worrying are:

- “That said, I accept Mr N mightn’t have read the User Agreement and may not have known about this specific provision. But even then, I think he would reasonably have known there’d be provisions in the agreement, which would be there to help safeguard payments, such as the review provisions.”

The only way a customer (who hasn’t read the 45-page user agreement) will know about this provision is if they have a crystal ball.

The government has recently announced plans to curb lengthy contracts full of jargon. Is paypal excluded?

- “Neither do I think Mr N was treated unfairly because he wasn’t told the payment review was going on. From what he says he had a bit of a tense time with the supplier before the payment arrived. But the payment was released to the supplier after 24 hours. Mr N got the service he wanted from the supplier and I can’t see that time was of the essence for this particular transaction.”

The laws passed by Parliament says the payment services provider have to tell customer the time for processing the transaction. Paypal did not provide this. Paypal’s marketing material said “simple and convenient”. I can see that FOS decided in favour of Paypal even when a customer attempted to obtain an emergency visa, and his payment was “reviewed”. See ombudsman decision: DRN9697648.

- “Mr N has put forward arguments to suggest that there is legislation that means that he is entitled to a better customer service than PayPal agrees to provide under the User Agreement. I think those are arguments that would be better taken to a court as he is asking us to look at whether the User Agreement is in line with or breaches the provisions he mentions and only a court can comment on that specific issue.”

Not correct. I asked the FOS to keep to the guidance by the Financial Services Authority (FSA), which require the FOS to take into account relevant laws.

Notes –

[1] – If the payment had gone through initially everything would have been done seamlessly/automatically and I would have had immediate access to the course material and learning platform.

[2] – See: DISP 3.6.4R of the Financial Conduct Authority Handbook – https://www.handbook.fca.org.uk/handbook/DISP/3/6.html

[3 ] – Ombudsman takes a while to publish their decisions on their ombudsman decisions website. However, I’ve made the decision available here, with personal info and sensitive info redacted.